Mobile Money Metrics

Mobile Money

Mobile money is a form of electronic transfer which allows customers to send or receive money through their mobile phones. Mobile phones have become an integral part of the lives of many people in developing countries and have been used as a tool for financial inclusion, especially in Africa.

Mobile money transfers are usually done through an agent who takes cash from the customer and credits the customer’s mobile money account with the amount.

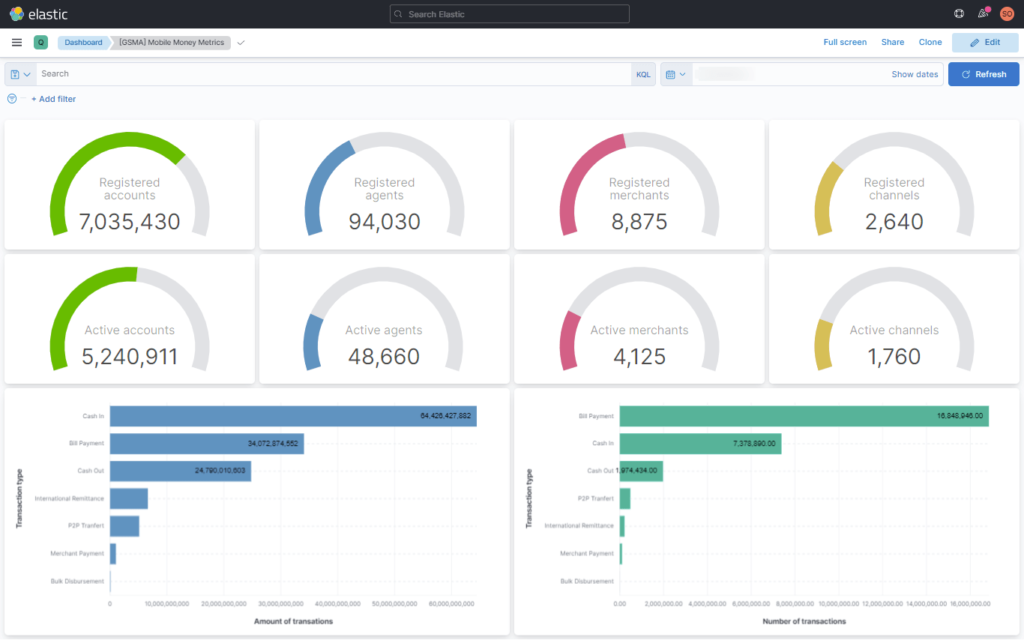

Mobile Money Metrics

Metrics are typically used to measure how well a business is performing against its goals. Metrics are often considered a quantifiable measurement that, when compared to its own individual historical data, can indicate whether or not a business is trending positively or negatively towards its goal.

Here are some metrics we use to understand and measure our client data and help them to achieve their goals :

Registered accounts : The accumulated number of client accounts. Customers who are not registered but who trade over-the-counter (OTC) are not included. Some mobile money services are offered predominantly over-the-counter (OTC). In these cases, a mobile money agent completes the transactions on behalf of the customer, who does not need to have a mobile money account to use the service.

Active accounts: active accounts are derived from: The number of customer accounts that have been used to send or receive payments, cash out to a mobile wallet, transfer funds to bank accounts or make purchases using a mobile commerce service, for at least 90 days in the previous year.

Registered agents: The number of registered agents providing cash-in and cash-out services at the end of the year.

Active agents: Active agents are those agents who have completed at least one or more transactions in the previous 30 days from December to the end of the year indicated.

Person-to-Person (P2P) transfer: P2P stands for “Person to Person” which means a simple transfer. a transfer of funds between your Mobile Money account and the Mobile Money account of another individual. The transaction is initiated and completed by the two people exchanging funds with Mobile Money simply by providing the network to complete the transaction.

International remittance: The transfer of funds across borders from one person to another. This transaction can be directly sent from a mobile money account or can be carried out by using an intermediary organization, such as Western Union.

Bill payment: A Mobile payment is a payment made by an individual from his/her mobile money account or over the counter to a biller or billing organization via a mobile money platform in exchange for goods and services provided.

Merchant payment: All payments made from a mobile money account or via a mobile money platform to retail, online merchants in exchange for goods or services.

Bulk disbursement: As a mobile money user, you can receive payments directly into your mobile money account from the organization, by phone via a shortcode, or by SMS.

Cash-in: This means depositing cash into the customer’s Mobile Money wallet, this operation is handled by an agent who takes cash from the customer and credits the customer’s mobile money account with the amount.

Cash-out: Represent the opposite of the cash-in the customer deducts cash from their mobile money account, also in this phase an agent participe to give the customer cash in exchange for a transfer of e-money from the customer’s mobile money account.

Linkedin | Twitter | Youtube | Free training

Posted on April 28, 2022 by Yassine, LASRI