Know Everything About Your Telecom Metrics

Today, customers expect personalized and instant solutions. So, how do telecom companies keep their customers satisfied and encourage them to stay?

By delivering excellent customer service and attractive telecom bundles and packages.

And the best way to evaluate good customer service, bundle pricing, and improve customer satisfaction is by measuring telecom metrics.

In this article, we will list eight fundamental telecom metrics that most companies use to understand how they help achieve greater customer satisfaction and significant company growth. But before delving into the metrics, make sure that you are familiar with CDR, UDR, and EDR network elements logs.

8 Telecom Metrics to Track Company Growth Using CDR, UDR, and EDR Network Elements Logs

Telecom companies gather tons of subscriber data through CDR, UDR, and EDR network elements logs. However, just collecting data is not enough.

To make the most of the available data, telecom operators must strategically choose the metrics they want to track and how often they wish to monitor them. With this, they can extract valuable business information and not an overwhelming pile of irrelevant insights. Let’s discuss some vital telecom metrics below:

Metric 1: Monthly Active Customers

Monthly active customers is a telecom metric commonly used by companies to identify the unique users who have engaged with their products or services within the last month. Companies usually track monthly active customers by using a unique identification attribute like a user ID, a username, or an email address. This metric is a key performance indicator (KPI) that measures user engagement.

The active customer metric counts the unique customer IDs available in the CDR, UDR, and EDR network elements logs. It is also worth noting that the time window for calculating active customers can be a year, a quarter, a month, or even daily, depending on the telecom operator’s business requirements. The active customer metric is directly linked with the order count metric, which we will discuss next.

Metric 2: Monthly Order Count

The monthly order count is an important telecom metric that helps gather valuable information about the telecom companies’ products, subscriptions, and services. It keeps track of how many calls, texts, and data bundles are purchased by the subscriber. This metric tells telecom operators about the performance of their offered bundles and packages. Order count can be calculated by extracting invoice numbers and the relevant product purchase quantities from the network logs.

It is appropriate to track the order count telecom metric on a daily, weekly, monthly, quarterly, or yearly basis depending on the type of bundle purchased by the subscriber. Using this metric, telecom companies can understand their subscribers’ usage patterns and preferences and offer them personalized bundles to retain them for a long time.

Metric 3: Average Revenue per Order

The average revenue per order or average order value (AOV) tracks a customer’s average amount spent while placing a product order or purchasing a bundle. To calculate the average income per order, divide the total revenue by the number of orders for a given period. AOV can be formulated as:

Average Revenue Per Order = Total Revenue / Number of Orders

For instance, if a telecom company had 1000 orders a month and the total revenue was $50,000, the average income per order would be $50.

The average revenue per order is a key performance indicator that telecom companies use to measure and understand their customer’s purchasing habits. This metric can be tracked for any period, but most companies use it to monitor the moving monthly average.

This metric is indispensable as it helps evaluate the telecom operator’s overall marketing efforts and pricing strategy. It is needed to measure the long-term value of individual customers. Companies can increase the average order price by strategically adjusting prices like offering discounts, upselling, cross-selling, or free shipping.

Metric 4: Customer Retention Rate

Retention rate refers to the total number of customers that continue to use the telecom operators’ services over time. It is a vital indicator of the financial health of the telecom company. Many companies put a lot of time and effort into finding new customers, but keeping an existing customer happy is much cheaper.

Telecom companies should carefully monitor the customer retention rate as it indicates how well their products fit the market and subscribers. To calculate the customer retention rate, telecom companies can track how many customers are retained from the previous period using CDR, UDR, and EDR network elements logs. First, sum the total customers (let’s say 120,000) a telecom company has at the end of a given period (e.g., month). From that, subtract the number of new customers (40,000) over the same period. Then, divide the difference by the number of customers (100,000) at the beginning of the month and multiply that by one hundred. The formula would be expressed as:

Customer retention rate = Number of customers at the end of the defined window – Number of new customers acquired over the defined window / Number of customers at the beginning of window x 100

Let’s plug in the values.

Customer retention rate = 120,000 – 40,000 / 100,000 * 100 = 80%

That is an 80% retention rate, meaning a 20% subscriber drop in a month. The same metric would be calculated over a quarter and a year. Ideally, telecom companies want that number closer to 100%.

Tracking monthly retention rates can highlight issues that may result in subscriber loss, allowing telecom companies to apply corrective measures beforehand.

Metric 5: Cohort-Based Retention Rate

To boost customer retention, telecom companies should identify what makes their existing customers stay. Cohort analysis provides another telecom metric for observing the subscriber data and predicting the customer’s future behavior. It helps operators observe how recent and old cohorts differ regarding retention rates.

A cohort is generally referred to as a group of users who share a common characteristic. It is the study of the standard features of these users over a specific period. The cohort retention rate metric usually falls under two categories: behavioral cohort and acquisition cohort.

In terms of telecom, cohorts or user groups are determined from their acquisition date, i.e., the date on which the customers made their first subscription or bundle purchase. However, telecom companies can also monitor the patterns or behaviors of different customers using different bundles or subscriptions. For instance, operators can track the percentage of subscribers that are using nightly bundles every month. Cohort analysis can also be done on a monthly, quarterly, or yearly basis.

Metric 6: New Customer Ratio

As the name suggests, the new customer ratio metric signifies the percentage of new telecom subscribers over a given period which can be monthly, quarterly, or yearly.

To calculate this ratio, record the number of unique customers at the start and end of the given period. Take their difference, which shows how many new subscribers have started using the network. Then divide the difference by the total number of customers at the start of the given period and multiply it by one hundred to get the ratio. The formula is expressed as:

New customer ratio = Number of customers at the end of the given period – Number of customers at the start of the given period / Number of customers at the start of the given period x 100

For instance, if the telecom company had 100,000 customers at the start of the month (let’s say 1st December) and they managed to acquire 140,000 customers at the end of the same month (30th December), then the new customer ratio metric would be calculated as:

New customer ratio = 140,000 – 100,000 / 100,000 * 100 = 40%

In this scenario, the telecom company acquired 40% of new customers over 30 days–which is good.

Metric 7: Gross Monthly Revenue

Gross monthly revenue–not to be confused with net monthly revenue, sums up the total sales revenue of the telecom operator over a period (month, in this case). Like most metrics discussed above, gross revenue can be calculated over a quarter or a year.

Gross revenue records the price of the number of services and subscriptions sold by the telecom company. It does not include any discounts on bundles and packages. For instance, giving free product (like a network adapter) replacement if it is damaged within a year of purchase. By subtracting all such expenses from the gross revenue, we get the net revenue.

That’s the end of our list of telecom metrics. When selecting the right set of telecom metrics to analyze the CDR, UDR, and EDR network logs, there is no one-size-fits-all. Each telecom company would prefer metrics according to its requirements.

Want to Get Valuable Data Insights And Improve Profitability? Try S-One Analytic!

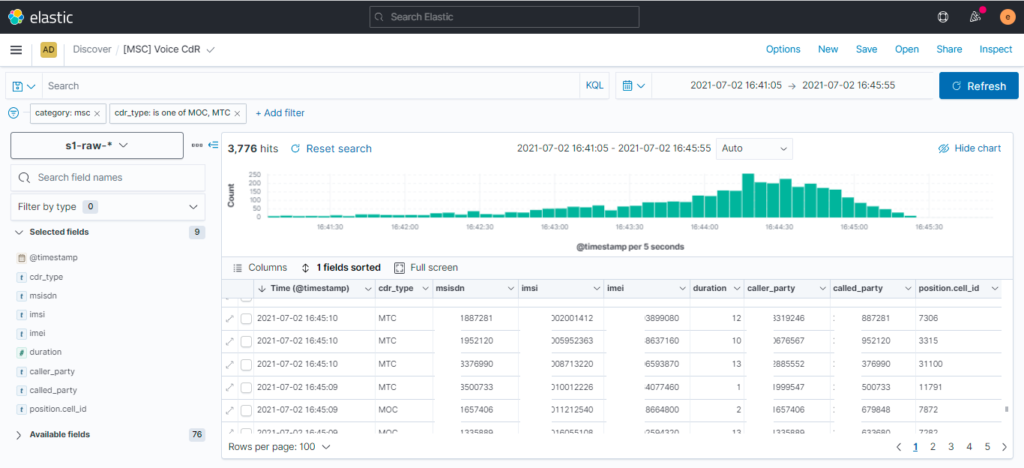

S-One Analytics is a big data analytics and events processing platform that can integrate over 150 telecom plugins, allowing it to ingest massive volumes of raw data. It empowers data engineers and business analysts to transform this raw data into analytics-ready datasets in minutes.

S-One Analytics empowers your company to become more data-driven by tracking the right set of telecom metrics. It makes your data and BI teams more productive as they can answer business questions in seconds. It allows telecom companies to proactively take new initiatives or deploy corrective measures to gain new customers or retain existing ones.

Your free demo is waiting for you. Speak with our product expert today!

Linkedin | Twitter | Youtube | Free training

Posted on June 29, 2022 by Yassine, LASRI