What KPIs and Dashboards Can You Expect from a Mobile Money Transactions Monitoring Solution like S-ONE MFS?

With the rapid rise of Mobile Money services, telecom operators must ensure the integrity, performance, and reliability of mobile transactions. In this context, a dedicated monitoring solution for mobile financial transactions is essential to quickly detect anomalies and optimize revenue. Discover how S-ONE MFS, Synaptique’s Mobile Financial Services monitoring platform, provides dashboards and key performance indicators (KPIs) that help operations, finance, and commercial teams make faster, more informed decisions.

What is S-ONE MFS and How Can It Support Mobile Money Monitoring?

S-ONE MFS is Synaptique’s advanced Mobile Financial Services (MFS) monitoring solution designed for telecom operators. With the rapid rise of mobile money usage across emerging and mature markets, ensuring the integrity, performance, and reliability of mobile money transactions is a growing necessity.

S-ONE MFS provides real-time and historical data visualization, empowering telecom operators with actionable insights across mobile money activities, including peer-to-peer transfers, bill payments, airtime top-ups, merchant transactions, and more.

While S-ONE MFS focuses on operational performance and transaction intelligence, it does not include anti-money laundering (AML) or counter-terrorism financing (CTF) functionalities. Instead, it serves as a powerful observability tool, offering robust analytics, automated alerts, and business intelligence dashboards for revenue assurance and service optimization.

For a complete overview of the features and benefits, you can:

- Download the Brochure

- Book a Call with our team to see the platform in action

What KPIs Can S-ONE MFS Track?

S-ONE MFS provides a rich set of Key Performance Indicators (KPIs) that give telecom operators granular visibility into their mobile money services. Here are the core KPIs the platform can monitor:

Total Transactions

- Tracks the number of transactions processed within specific intervals (daily, weekly, monthly).

- Helps quantify service usage and growth trends.

Transaction Success Rate

- Measures the percentage of successful transactions compared to those that fail.

- Useful for identifying service reliability and technical issues.

Average Transaction Value

- Calculates the average value of all completed transactions.

- Offers insight into user spending behaviors and service value.

Transaction Volume by Channel

- Breaks down transaction data by access channel (e.g., mobile app, USSD, SMS).

- Reveals user preferences and highlights underperforming channels.

Processing Time

- Monitors the average duration for transaction processing.

- Identifies bottlenecks and areas requiring performance optimization.

Error/Failure Rates

- Reports on the frequency of failed transactions caused by system errors or technical issues.

- Crucial for proactive incident management.

User Activity Metrics

- Tracks usage frequency, average transactions per user, and wallet activity.

- Supports customer engagement analysis and service optimization.

Alert Counts

- Monitors the number of system-generated alerts due to anomalies or outliers in transactional behavior.

- Enables rapid response to irregular patterns.

System Availability / Uptime

- Measures platform uptime to ensure reliability and consistent user access.

- Integral for SLA compliance and user satisfaction.

How Are Dashboards Structured in S-ONE MFS?

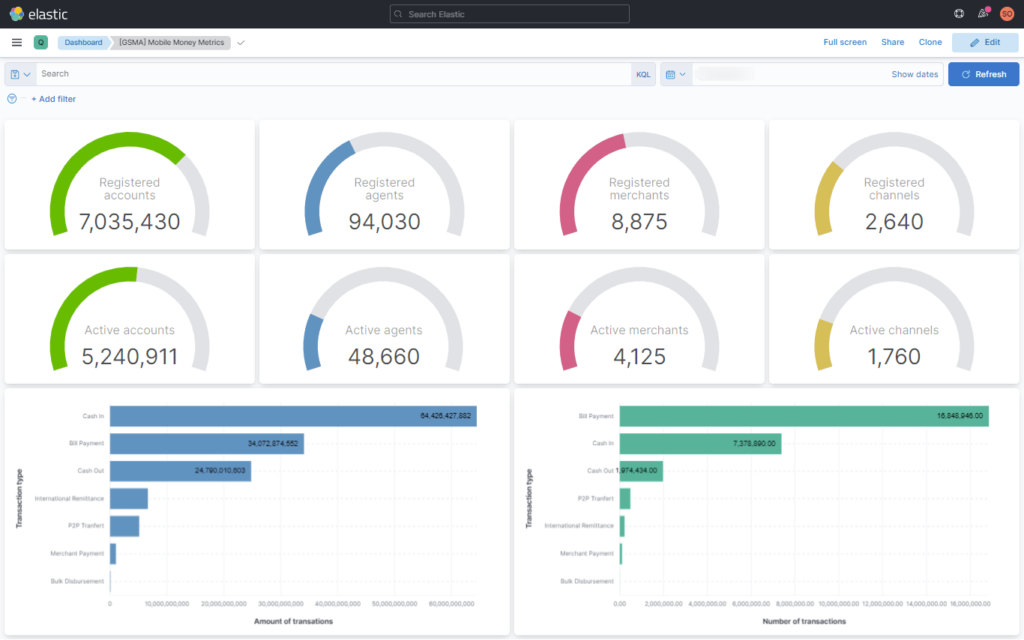

The dashboards in S-ONE MFS are fully customizable and built using intuitive data visualization tools. They are designed for different operational teams including network operations, finance, and customer service. Dashboards include:

- Operational Monitoring Dashboards

- Live views of transaction counts and success rates

- Alerts for service degradation or outages

- Revenue Insights Dashboards

- Visual breakdown of revenue per service type

- Profitability of agent networks

- Usage & Adoption Dashboards

- Geographic spread of mobile money usage

- Service adoption rates per user segment

- Anomaly Detection Dashboards

- Heatmaps and graphs showing abnormal patterns

- Filters to investigate specific MSISDNs, transaction types, or service periods

How Does S-ONE MFS Help Telecom Operators Make Faster, Smarter Decisions?

S-ONE MFS provides:

- Real-time alerts on transaction failures or volume spikes

- Historical analysis to identify trends and performance issues over time

- Segmented insights to tailor service offerings by user behavior or region

- Exportable reports for management, technical teams, or external partners

This actionable intelligence allows telecom operators to:

- Ensure higher uptime and service continuity

- Improve customer experience by identifying issues quickly

- Optimize agent network coverage and liquidity

- Understand user behavior and introduce new services strategically

Why Is S-ONE MFS a Strategic Tool for Telecom Operators?

Unlike banking-centric monitoring tools, S-ONE MFS is developed with telecom operators in mind. It integrates seamlessly with mobile network systems and provides:

- Minimal deployment time with flexible APIs

- Scalability to match transaction growth

- Telecom-grade security and data management

Moreover, operators can prioritize customer experience and revenue tracking without navigating complex regulatory compliance requirements tied to AML or CTF tools.

Want to See S-ONE MFS in Action?

Our team is happy to show you how S-ONE MFS can be tailored to your needs:

- [Download the Brochure] for an in-depth view of features

- [Book a Call] to schedule a personalized demo with one of our experts

Make mobile money monitoring smarter, faster, and operator-focused with S-ONE MFS.

Avec l’essor fulgurant des services de Mobile Money, les opérateurs télécoms doivent garantir l’intégrité, la performance et la fiabilité des transactions mobiles. Dans ce contexte, une solution de supervision dédiée aux transactions financières mobiles devient essentielle pour détecter rapidement les anomalies et optimiser les revenus. Découvrez comment S-ONE MFS, la plateforme de surveillance Mobile Financial Services de Synaptique, fournit des tableaux de bord et des indicateurs clés (KPIs) qui aident les équipes opérationnelles, financières et commerciales à prendre des décisions plus rapides et plus éclairées.

Qu’est-ce que S-ONE MFS et comment supporte-t-il la supervision Mobile Money ?

S-ONE MFS est la solution avancée de Mobile Financial Services (MFS) conçue par Synaptique pour les opérateurs télécoms. Face à l’adoption croissante du Mobile Money dans les marchés émergents et établis, il est devenu indispensable de garantir la fiabilité des transactions en temps réel.

La plateforme offre une visualisation des données en temps réel et historique, fournissant aux opérateurs des insights exploitables sur l’ensemble des activités Mobile Money : transferts entre particuliers, paiements de factures, recharges de crédit, transactions auprès des commerçants, etc.

Note importante : S-ONE MFS se concentre sur la performance opérationnelle et l’intelligence transactionnelle. Il ne comporte pas de fonctionnalités de lutte contre le blanchiment (AML) ou de financement du terrorisme (CTF). C’est avant tout un outil d’observabilité, avec des analyses robustes, des alertes automatiques et des tableaux de bord BI dédiés à l’assurance revenus et à l’optimisation du service.

Pour un aperçu complet des fonctionnalités et bénéfices :

- Téléchargez la brochure

- Planifiez un appel

Quels indicateurs clés (KPIs) S-ONE MFS peut-il suivre ?

S-ONE MFS propose un ensemble riche de KPIs pour offrir une visibilité granulaire sur les services Mobile Money :

- Total des transactions

Suivi du nombre de transactions réalisées sur des périodes définies (quotidien, hebdomadaire, mensuel).

→ Mesure de l’adoption et des tendances de croissance. - Taux de succès des transactions

Pourcentage de transactions réussies versus celles échouées.

→ Permet d’identifier la fiabilité du service et les problèmes techniques. - Valeur moyenne des transactions

Calcul de la valeur moyenne de toutes les transactions validées.

→ Donne des indications sur le comportement des utilisateurs et le panier moyen. - Volume par canal

Répartition des transactions selon le canal d’accès (application mobile, USSD, SMS).

→ Met en évidence les préférences utilisateurs et les canaux sous-performants. - Temps de traitement

Surveillance de la durée moyenne nécessaire pour traiter une transaction.

→ Permet de détecter les goulets d’étranglement et d’améliorer la performance. - Taux d’erreurs/échecs

Fréquence des transactions échouées suite à une erreur système ou un incident technique.

→ Crucial pour la gestion proactive des incidents. - Activité utilisateur

Fréquence d’utilisation, nombre moyen de transactions par utilisateur, activité des portefeuilles.

→ Utile pour analyser l’engagement et optimiser les services. - Nombre d’alertes

Comptabilisation des alertes générées par le système suite à des anomalies transactionnelles.

→ Permet de réagir immédiatement aux comportements suspects. - Disponibilité du système / Uptime

Mesure du temps de disponibilité de la plateforme pour garantir une accessibilité constante des utilisateurs.

→ Indispensable pour le respect des SLA et la satisfaction clients.

Comment sont structurés les tableaux de bord dans S-ONE MFS ?

Les tableaux de bord de S-ONE MFS sont entièrement personnalisables et conçus pour différents services : exploitation réseau, finance, support client, etc. :

1. Tableaux de bord de supervision opérationnelle

- Vue en temps réel du nombre de transactions et des taux de succès

- Alertes sur dégradation ou interruption de service

2. Tableaux de bord d’analyse des revenus

- Répartition visuelle des revenus par type de service (transferts, recharges, paiements)

- Rentabilité des réseaux d’agents

3. Tableaux de bord d’utilisation et d’adoption

- Répartition géographique de l’usage Mobile Money

- Taux d’adoption par segment d’utilisateurs

4. Tableaux de bord de détection d’anomalies

- Cartes thermiques et graphiques des comportements transactionnels anormaux

- Filtres pour investiguer par MSISDN, type de transaction ou plage temporelle

Comment S-ONE MFS permet aux opérateurs de prendre des décisions plus rapides et plus avisées ?

S-ONE MFS offre :

- Alertes en temps réel sur échecs de transactions ou pics de volume

- Analyses historiques pour identifier tendances et problèmes de performance au fil du temps

- Insights segmentés pour adapter l’offre selon le comportement ou la région

- Rapports exportables pour la direction, les équipes techniques ou les partenaires externes

Ces informations permettent aux opérateurs de :

- Garantir une disponibilité maximale et la continuité du service

- Améliorer l’expérience client en corrigeant rapidement les incidents

- Optimiser la couverture des agents et la liquidité des portefeuilles

- Comprendre le comportement des utilisateurs et lancer de nouveaux services à forte valeur

Pourquoi S-ONE MFS est-il un outil stratégique pour les opérateurs télécom ?

Contrairement aux solutions bancaires classiques, S-ONE MFS a été développé pour les opérateurs télécom :

- Déploiement rapide grâce à des API flexibles

- Scalabilité pour accompagner la croissance des volumes transactionnels

- Sécurité “telecom-grade” et gestion des données conforme

De plus, les opérateurs peuvent se concentrer sur la qualité de l’expérience client et la surveillance des revenus sans devoir gérer la complexité réglementaire liée aux outils AML/CTF.

Découvrir S-ONE MFS en action ?

Notre équipe se tient à votre disposition pour vous montrer comment S-ONE MFS s’adapte à vos besoins :

- Téléchargez la brochure pour un aperçu approfondi des fonctionnalités

- Réservez un appel pour planifier une démonstration personnalisée

Rendez la supervision Mobile Money plus intelligente, plus rapide et plus centrée sur l’opérateur avec S-ONE MFS.

Guarding Your Mobile Money: How to Stay Ahead of SIM Swap Fraudsters

Mobile money has become an indispensable tool for financial transactions across the globe. However, as this innovative technology grows, so does the sophistication of cybercriminals. One of the most alarming threats to mobile money security is SIM swap fraud,a technique that can lead to devastating financial losses for both individuals and businesses.

The rise of SIM swap fraud casts a shadow over digital financial freedom. As cybercriminals refine their tactics, understanding and combating this threat is critical. This post unpacks SIM swap fraud, its growing prevalence, and actionable steps to safeguard your finances and identity.

What is SIM Swap Fraud?

SIM swap fraud occurs when fraudsters hijack a victim’s mobile phone number by tricking or bribing a mobile service provider into transferring the number to a new SIM card. Once in control of the victim’s phone number, attackers can intercept one-time passwords (OTPs), gain access to banking and mobile money accounts, and execute unauthorized transactions. This type of fraud is particularly dangerous because it exploits the trust and reliance on mobile networks for secure authentication.

The Rising Prevalence of SIM Swap Fraud

The frequency of SIM swap incidents has risen sharply. Cybercriminals are refining their tactics, making it increasingly difficult for even vigilant users to protect themselves. The mobile money industry is especially vulnerable due to its reliance on SMS-based verification methods. As a result, both consumers and financial institutions face a growing risk of unauthorized access and financial theft.

Potential Risks and Financial Losses

Financial Impact

SIM swap fraud can lead to significant financial losses. Once fraudsters gain access to a victim’s mobile money account, they can drain funds rapidly before the victim even realizes what has happened. For individuals, this may mean losing savings intended for daily needs or emergency funds. For businesses, particularly those operating in regions where mobile money is the primary mode of transaction, the losses can be catastrophic.

Identity Theft and Reputational Damage

Beyond direct financial loss, SIM swap fraud often paves the way for identity theft. Once attackers have control of a victim’s number, they can access sensitive personal information, leading to further fraudulent activities. This not only harms the individual’s financial standing but also damages their reputation and trust with financial institutions.

Operational Disruption

For mobile money operators, a successful SIM swap fraud attack can disrupt the entire system. The sudden surge in fraudulent transactions may overwhelm customer service centers and technical support teams, leading to service interruptions and eroding customer confidence.

How to Stay Ahead of SIM Swap Fraudsters

Strengthen Authentication Methods

Relying solely on SMS-based authentication is a major vulnerability. Mobile money providers are increasingly turning to multi-factor authentication (MFA), biometric verification, and app-based authentication systems to add an extra layer of security. By diversifying authentication methods, organizations can make it significantly harder for fraudsters to compromise accounts.

Proactive Monitoring and Real-Time Alerts

To stay ahead of increasingly sophisticated SIM swap fraudsters, mobile money operators need more than reactive security measures — they need proactive, real-time protection.

At Synaptique, we empower financial institutions with S-ONE MFS, our mobile money monitoring solution specifically designed to secure transactions, detect fraudulent activities, and protect end users. S-ONE MFS uses advanced analytics, real-time monitoring, and intelligent alerts to help operators quickly identify and neutralize threats before they cause major financial or reputational damage.

Advanced data monitoring solutions like S-ONE MFS can detect unusual activity patterns that may indicate a SIM swap attack. Real-time alerts and automated fraud detection algorithms allow mobile money providers to identify potential threats before they escalate, enabling a swift and effective response to mitigate damage.

Download the brochure to uncover the full spectrum of S-ONE MSF Features.

Educate Your Customers

Customer awareness is a powerful defense against SIM swap fraud. Educate your users on the signs of potential SIM swapping, such as unexpected loss of network service, unusual account activities, or unrecognized security messages. Empowering customers with knowledge helps them take immediate action, such as contacting their mobile service provider or financial institution.

Collaborate with Mobile Service Providers

Building a robust partnership with mobile network operators is crucial. Joint efforts to verify customer identity and monitor SIM card activity can reduce the risk of unauthorized number transfers. Regular audits and cross-checks between mobile money operators and service providers can further secure the authentication process.

Implement Strong Data Security Measures

Ensuring that customer data is stored securely and access is strictly controlled is essential. Regular security audits, encryption of sensitive information, and compliance with industry standards can help safeguard against both SIM swap fraud and other cyber threats.

Conclusion

The battle against SIM swap fraud is ongoing and requires a multi-layered approach. By integrating advanced authentication methods, real-time monitoring solutions, and comprehensive customer education, mobile money operators can significantly reduce the risk of fraudulent activities. The stakes are high not only is there the potential for substantial financial loss, but also the erosion of trust in digital financial services.

Stay vigilant, stay secure, and guard your mobile money from SIM swap fraudsters.

What is Mobile Money?

Mobile Money functions as an electronic wallet linked to the user’s SIM card. This wallet allows transactions like sending, receiving funds, or paying for services without a traditional bank account. Users can deposit or withdraw funds via a network of registered agents.

According to a 2019 report by the Central Bank of West African States (BCEAO), most frauds at Orange Finances Mobiles Senegal (OFMS) involved agents splitting customer deposits into multiple transactions to earn higher commissions.

There were also cases where agents embezzled commissions from cash withdrawals, and clients split merchant payments to gain more mobile credit bonuses.

Fraud in Mobile Money can be hard to detect. Understanding various fraud techniques and leveraging the data logs generated by Mobile Money systems are crucial in combating these frauds.

Types of Mobile Money Fraud

Below are the main types of Mobile Money fraud:

Cash-Out Fraud: Dishonest agents at sales points withdraw money from a user’s account without authorization. This type of fraud is common where agents exploit their position to illegally access and transfer funds. This often without the victim realizing until it’s too late.

Phishing Fraud: Involves social engineering techniques, such as fraudsters calling or messaging the victim, claiming that they accidentally sent money to their Mobile Money account. The fraudster then requests the victim return the money, tricking them into sending their own funds.

International Transfer Fraud: Mobile Money accounts are increasingly being used to illegally transfer stolen or laundered funds across borders. Fraudsters exploit the cross-border transfer capabilities of Mobile Money to move illicit funds. Making the tracing and recovery of the money difficult.

Commission Fraud: Agents may split customer deposits into smaller transactions to artificially inflate the commission they receive from the operator. This fraudulent activity not only undermines the operator’s commission structure but can also lead to inflated transaction fees for users.

SIM Swapping Fraud: Fraudsters use social engineering to convince mobile service providers to transfer a victim’s phone number to a new SIM card, allowing them to take over the victim’s Mobile Money account. This type of fraud has become increasingly sophisticated, with criminals often targeting individuals who have high-value accounts.

As of 2023, the risks associated with Mobile Money fraud continue to escalate. In recent years, it is estimated that the financial sector has faced substantial losses, with some reports suggesting that billions of dollars are lost annually due to sophisticated scams targeting Mobile Money services. As technology evolves, fraudsters are constantly adapting, employing increasingly complex methods to exploit system vulnerabilities. Consequently, the need for enhanced security measures and robust fraud detection systems has never been more critical in safeguarding against these threats.

Introducing S-ONE MFS

To effectively combat Mobile Money fraud, Synaptique offers S-ONE MFS, an advanced mobile money monitoring solution designed to protect telecom operators and their users from fraudulent activities. Our solution leverages cutting-edge technology to provide real-time detection and comprehensive analysis, ensuring the integrity of your Mobile Money services.

Protect your business and your customers by exploring how S-ONE MFS can be a game-changer in your fraud prevention strategy.

Download the brochure to learn more about S-ONE MFS.

For a live demonstration of S-ONE MFS capabilities, Book a Call today and see how we can transform your Mobile Money transactions Monitoring.

Mobile Money transfers are typically conducted through an agent who takes the customer’s cash and credits the customer’s account with the corresponding amount. This system enables users to perform financial transactions without the need for a traditional bank account, promoting greater accessibility and convenience.

Key Metrics for Measuring Mobile Money Activity

Metrics are essential for evaluating a company’s performance against its objectives. They are often considered quantifiable measures that, when compared to historical data, can indicate whether a company is trending positively or negatively toward its goals.

Below are some key metrics we use to understand and measure our clients data, helping them achieve their objectives:

Registered Accounts

The total number of customer accounts registered with the Mobile Money service. This metric excludes customers who perform over-the-counter (OTC) transactions without registering an account. In some services, especially those primarily offering OTC transactions, agents facilitate transactions on behalf of customers who do not hold a formal account.

Tracking registered accounts helps in assessing the user base’s growth and the penetration of digital financial services within the target population.

With the increasing push for digital financial inclusion, many regions are seeing a surge in registered accounts as governments and financial institutions promote account registration through incentives and regulatory requirements.

Active Accounts

The number of customer accounts that have been used to send or receive payments, make withdrawals, transfer funds to bank accounts, or make purchases using mobile commerce services within the last 90 days of the previous year.

Active accounts are a crucial indicator of user engagement and the ongoing utilization of Mobile Money services. High numbers of active accounts suggest that users find the service valuable and continue to integrate it into their daily financial activities.

The trend towards increased smartphone usage and improved network coverage has contributed to higher engagement rates, resulting in more active accounts as users leverage additional Mobile Money functionalities like bill payments and mobile savings.

Registered Agents

The number of agents registered to provide deposit and withdrawal services by the end of the year.

Agents are the backbone of the Mobile Money ecosystem, facilitating cash-in and cash-out transactions. Monitoring the number of registered agents helps assess the network’s reach and accessibility, ensuring that customers can easily access their funds.

Expansion of agent networks in rural and underserved areas continues to be a focus, driven by partnerships between providers and local businesses to enhance financial inclusion.

Active Agents

Agents who have conducted at least one transaction in the past 30 days, up to the end of the specified year.

Active agents indicate the operational health and reliability of the Mobile Money network. High numbers of active agents ensure that customers have consistent access to services and that the network remains robust and responsive to user needs.

Enhanced training programs and performance incentives for agents have led to increased activity levels, improving service reliability and customer satisfaction.

Person-to-Person (P2P) Transfers

Simple fund transfers between accounts, initiated and completed by the two parties involved.

P2P transfers are a fundamental feature of Mobile Money services, enabling users to send money to friends, family, or business associates quickly and securely. This metric reflects the platform’s utility for everyday financial interactions.

Integration with social media platforms and enhanced security features have made P2P transfers more seamless and secure, driving higher usage rates.

International Remittances

Cross-border transfers of funds from one person to another, either directly from a Mobile Money account or through intermediaries like Western Union.

International remittances are vital for many users who rely on money sent from abroad to support their families. This metric highlights the service’s role in facilitating global financial connectivity and economic support.

Increased regulatory support and partnerships with international financial institutions have streamlined cross-border transactions, reducing costs and increasing transaction volumes.

Bill Payments

Payments made from a Mobile Money account to a bill issuer or billing organization in exchange for goods and services.

Bill payments represent a significant use case for Mobile Money, allowing users to pay utilities, rent, and other recurring expenses conveniently from their mobile devices. This metric demonstrates the platform’s integration into users’ routine financial activities.

Expansion of bill payment options to include a wider range of services, such as education fees and healthcare payments, has further embedded Mobile Money into essential financial transactions.

Merchant Payments

Payments made to retail or online merchants in exchange for goods or services using a Mobile Money account or platform.

Merchant payments indicate the adoption of Mobile Money as a preferred payment method for both online and offline purchases. This metric reflects the service’s acceptance among businesses and its role in facilitating commerce.

Growth in e-commerce and partnerships with major retailers have significantly boosted merchant payment transactions, enhancing the overall ecosystem’s vibrancy.

Bulk Disbursements

Payments such as salaries, reimbursements, or other large-scale disbursements sent directly to a user’s Mobile Money account via phone codes or SMS.

Bulk disbursements simplify the process of distributing large sums of money to multiple recipients efficiently and securely. This metric is crucial for understanding how Mobile Money is utilized for organizational payments and financial management.

Increased adoption by employers and government agencies for payroll and social welfare programs has driven higher volumes of bulk disbursements, showcasing the platform’s scalability and reliability.

Cash-In

Depositing cash into a customer’s Mobile Money wallet through an agent.

Cash-in transactions are fundamental for users to load their Mobile Money accounts with funds. This metric measures the ease and frequency with which users can add money to their digital wallets.

Innovations such as instant cash-in via mobile apps and expanded agent networks have made depositing funds more convenient, increasing transaction volumes.

Cash-Out

Withdrawing cash from a customer’s Mobile Money account, facilitated by an agent.

Cash-out transactions allow users to convert their digital funds back into physical cash, providing flexibility and ensuring that Mobile Money remains a versatile financial tool.

Enhanced withdrawal options, including ATM integrations and partnerships with retail outlets, have broadened access to cash-out services, driving higher usage rates.

The Importance of Monitoring Mobile Money Metrics

Understanding and tracking these metrics is essential for assessing the performance, growth, and impact of Mobile Money services. By analyzing these indicators, Mobile Money providers can identify trends, optimize operations, enhance user experience, and implement targeted strategies to drive financial inclusion.

Introducing S-ONE MFS

To effectively monitor and analyze Mobile Money metrics, Synaptique offers S-ONE MFS, an advanced Mobile Financial Services monitoring solution. S-ONE MFS leverages cutting-edge technology? AI and Machine learning to provide real-time insights and comprehensive analytics, enabling telecom operators and financial institutions to detect and prevent fraudulent activities, optimize service performance, and enhance user satisfaction.

Our solution offers:

- Real-Time Monitoring: Continuously track transactions and user activities to identify anomalies and potential fraud.

- Comprehensive Analytics: Gain deep insights into transaction patterns, user behavior, and service utilization.

- Customizable Dashboards: Visualize key metrics and performance indicators tailored to your specific needs.

- Automated Reporting: Generate detailed reports to support decision-making and strategic planning.

- Enhanced Security: Protect your Mobile Money ecosystem with robust security measures and fraud detection capabilities.

Download our brochure to learn more about how S-ONE MFS can revolutionize your Mobile Money monitoring and analytics.

For a live demonstration of S-ONE MFS capabilities, Book a Call today and see how we can transform your Mobile Money transactions Monitoring.

Upcoming Events

- All

- Webinar

- Conference

- Expo

novembre 13, 2024

Webinar Preventing Revenue Leakage Core vs. Intelligent Network Reconciliation

join us for an insightful live session on " Core…

Read Moreseptembre 14, 2024

Synaptique at GITEX GLOBAL 2024

Join our team at GITEX Global from October 18 to 24,…

Read Moreseptembre 5, 2024

Synaptique at TARS Africa 2024 in Casablanca 12-13 September

Join us at TARS Africa 2024 in Casablanca 12-13 September,…

Read More