What is S-ONE MFS and How Can It Support Mobile Money Monitoring?

S-ONE MFS is Synaptique’s advanced Mobile Financial Services (MFS) monitoring solution designed for telecom operators. With the rapid rise of mobile money usage across emerging and mature markets, ensuring the integrity, performance, and reliability of mobile money transactions is a growing necessity.

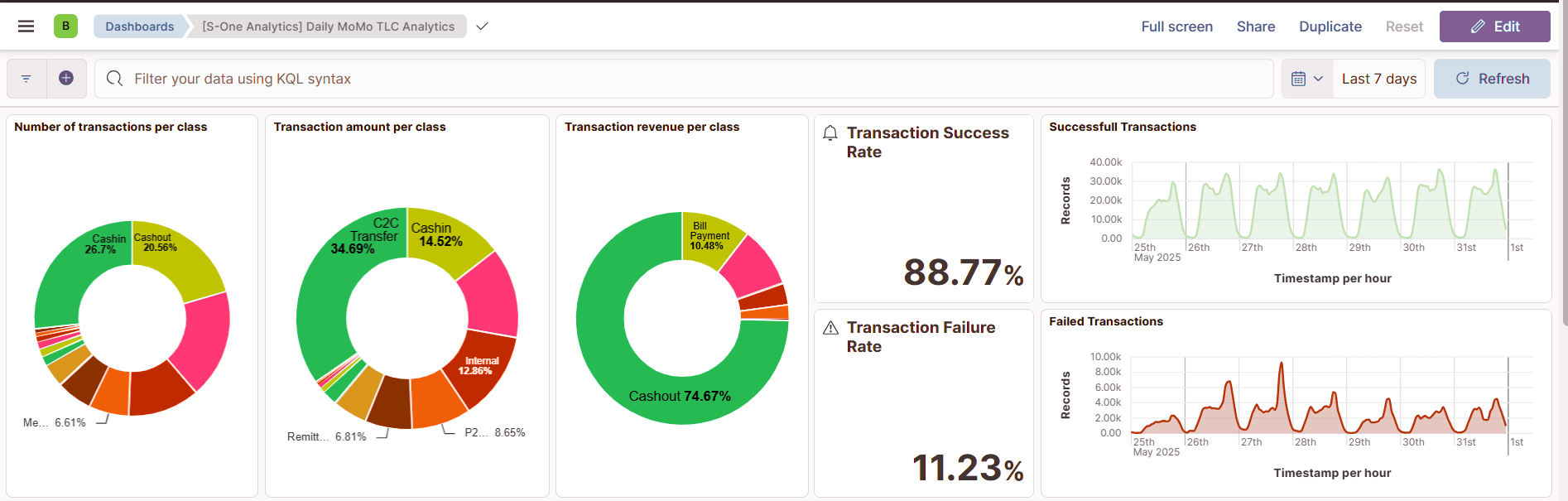

S-ONE MFS provides real-time and historical data visualization, empowering telecom operators with actionable insights across mobile money activities, including peer-to-peer transfers, bill payments, airtime top-ups, merchant transactions, and more.

While S-ONE MFS focuses on operational performance and transaction intelligence, it does not include anti-money laundering (AML) or counter-terrorism financing (CTF) functionalities. Instead, it serves as a powerful observability tool, offering robust analytics, automated alerts, and business intelligence dashboards for revenue assurance and service optimization.

For a complete overview of the features and benefits, you can:

- Download the Brochure

- Book a Call with our team to see the platform in action

What KPIs Can S-ONE MFS Track?

S-ONE MFS provides a rich set of Key Performance Indicators (KPIs) that give telecom operators granular visibility into their mobile money services. Here are the core KPIs the platform can monitor:

Total Transactions

- Tracks the number of transactions processed within specific intervals (daily, weekly, monthly).

- Helps quantify service usage and growth trends.

Transaction Success Rate

- Measures the percentage of successful transactions compared to those that fail.

- Useful for identifying service reliability and technical issues.

Average Transaction Value

- Calculates the average value of all completed transactions.

- Offers insight into user spending behaviors and service value.

Transaction Volume by Channel

- Breaks down transaction data by access channel (e.g., mobile app, USSD, SMS).

- Reveals user preferences and highlights underperforming channels.

Processing Time

- Monitors the average duration for transaction processing.

- Identifies bottlenecks and areas requiring performance optimization.

Error/Failure Rates

- Reports on the frequency of failed transactions caused by system errors or technical issues.

- Crucial for proactive incident management.

User Activity Metrics

- Tracks usage frequency, average transactions per user, and wallet activity.

- Supports customer engagement analysis and service optimization.

Alert Counts

- Monitors the number of system-generated alerts due to anomalies or outliers in transactional behavior.

- Enables rapid response to irregular patterns.

System Availability / Uptime

- Measures platform uptime to ensure reliability and consistent user access.

- Integral for SLA compliance and user satisfaction.

How Are Dashboards Structured in S-ONE MFS?

The dashboards in S-ONE MFS are fully customizable and built using intuitive data visualization tools. They are designed for different operational teams including network operations, finance, and customer service. Dashboards include:

- Operational Monitoring Dashboards

- Live views of transaction counts and success rates

- Alerts for service degradation or outages

- Revenue Insights Dashboards

- Visual breakdown of revenue per service type

- Profitability of agent networks

- Usage & Adoption Dashboards

- Geographic spread of mobile money usage

- Service adoption rates per user segment

- Anomaly Detection Dashboards

- Heatmaps and graphs showing abnormal patterns

- Filters to investigate specific MSISDNs, transaction types, or service periods

How Does S-ONE MFS Help Telecom Operators Make Faster, Smarter Decisions?

S-ONE MFS provides:

- Real-time alerts on transaction failures or volume spikes

- Historical analysis to identify trends and performance issues over time

- Segmented insights to tailor service offerings by user behavior or region

- Exportable reports for management, technical teams, or external partners

This actionable intelligence allows telecom operators to:

- Ensure higher uptime and service continuity

- Improve customer experience by identifying issues quickly

- Optimize agent network coverage and liquidity

- Understand user behavior and introduce new services strategically

Why Is S-ONE MFS a Strategic Tool for Telecom Operators?

Unlike banking-centric monitoring tools, S-ONE MFS is developed with telecom operators in mind. It integrates seamlessly with mobile network systems and provides:

- Minimal deployment time with flexible APIs

- Scalability to match transaction growth

- Telecom-grade security and data management

Moreover, operators can prioritize customer experience and revenue tracking without navigating complex regulatory compliance requirements tied to AML or CTF tools.

Want to See S-ONE MFS in Action?

Our team is happy to show you how S-ONE MFS can be tailored to your needs:

- Download the Brochure for an in-depth view of features

- Book a Call to schedule a personalized demo with one of our experts

Make mobile money monitoring smarter, faster, and operator-focused with S-ONE MFS.